Real Estate Reno Nv Things To Know Before You Buy

How Real Estate Reno Nv can Save You Time, Stress, and Money.

Table of ContentsExcitement About Real Estate Reno NvThe Facts About Real Estate Reno Nv UncoveredThe Of Real Estate Reno NvAbout Real Estate Reno Nv

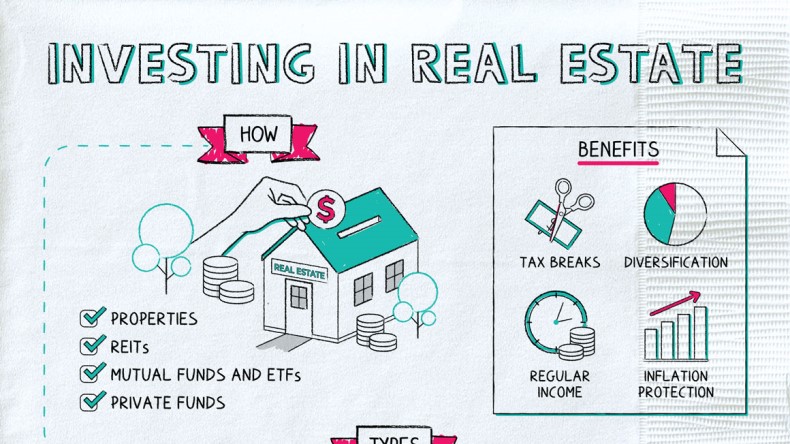

That may appear costly in a globe where ETFs and shared funds may charge just absolutely no percent for constructing a varied profile of stocks or bonds. While systems might vet their investments, you'll have to do the very same, which implies you'll need the abilities to examine the chance.Caret Down Funding gratitude, dividend or passion repayments. Like all investments, realty has its benefits and drawbacks. Below are several of one of the most crucial to remember as you weigh whether to buy property. Lasting recognition while you live in the residential property Prospective bush versus inflation Leveraged returns on your financial investment Passive income from leas or with REITs Tax benefits, including rate of interest deductions, tax-free resources gains and depreciation write-offs Dealt with long-term funding available Admiration is not guaranteed, specifically in economically clinically depressed areas Residential property prices might drop with higher rates of interest A leveraged financial investment suggests your deposit goes to risk Might require considerable money and time to manage your very own residential or commercial properties Owe a set home mortgage payment on a monthly basis, even if your renter does not pay you Lower liquidity genuine property, and high compensations While realty does provide lots of benefits, especially tax advantages, it does not come without substantial drawbacks, particularly, high payments to leave the market.

Or would certainly you like to analyze bargains or financial investments such as REITs or those on an on the internet system? Knowledge and abilities While numerous capitalists can discover on the job, do you have special abilities that make you better-suited to one type of financial investment than an additional? The tax obligation benefits on real estate vary commonly, depending on just how you invest, but investing in genuine estate can supply some sizable tax advantages.

A Biased View of Real Estate Reno Nv

REITs supply an attractive tax profile you will not sustain any kind of capital acquires taxes up until you market shares, and you can hold shares essentially for decades to prevent the tax obligation male. You can pass the shares on to your beneficiaries and they won't owe any type of taxes on your gains (Real Estate Reno NV).

Real estate can be like this an appealing investment, however financiers wish to be sure to match their kind of investment with their desire and capability to manage it, including time commitments. If you're wanting to generate income during retirement, real estate investing can be one way to do that.

There are several advantages to purchasing property. Constant income circulation, solid yields, tax obligation advantages, diversification with well-chosen properties, and the capability to take advantage of wealth via property are all advantages that investors might appreciate. Below, we dig into the numerous advantages of buying realty in India.

All about Real Estate Reno Nv

Realty often tends to appreciate in worth gradually, so if you make a smart financial investment, you can benefit when it comes time to market. Gradually, rents likewise tend to enhance, which might increase capital. Rents raise when economies increase since there is even more demand genuine estate, which raises funding worths.

Among the most appealing resources of passive earnings is rental profits. Among the easiest techniques to preserve a constant income after retirement is to do this. If you are still functioning, you might increase your rental income by investing it following your monetary purposes. There are numerous tax obligation benefits to real estate investing.

It will significantly minimize taxable income while lowering the price of genuine estate investing. Tax deductions are offered for a variety of expenses, such as business expenses, cash money circulation from other properties, and home loan interest.

Property's web link to the other major possession teams is vulnerable, at times even unfavorable. Real estate might as a result reduce volatility and increase return on danger Resources when it is consisted of in a portfolio of numerous possessions. Contrasted to other properties like the securities market, gold, cryptocurrencies, and financial institutions, purchasing property can be substantially safer.

The 20-Second Trick For Real Estate Reno Nv

The stock exchange is constantly transforming. The realty market has actually expanded over the previous several years as a result of the application of RERA, lowered home mortgage rates of click here to find out more interest, and various other factors. Real Estate Reno NV. The rate of interest prices on financial institution savings accounts, on the other hand, are low, particularly when contrasted to the climbing inflation